Martha’s Vineyard Real Estate 2022 Year-end Market Commentary

Happy belated New Year to one and all, and so long to 2022! As has become customary, we offer our annual installment of “The Year in Review” concerning Martha’s Vineyard Real Estate activities.

The past year was a tale to two markets with the late winter/early spring months carrying the “FOMO" momentum that developed in 2021 as buyers were actively acquiring property as a ‘safe haven’ from Covid and sellers were eager to convey property at elevated prices. But then the Federal Reserve policy change with increased interest rates beginning in July provided a notable “cooling” to the Island’s real estate market and a reassessment of lending risk made by participating banks. Fortunately, Q4 demonstrated a return to greater engagement between Buyers and Sellers, but the late season inventory that often materializes after Labor Day to participate in the truncated Fall market was not delivered as compared to recent history. Shifting sands indeed…

The motivation to acquire property on-Island remains high, despite the change in the macro-economic environment coupled with higher interest rates. Unquestionably there are a greater number of prospective buyers currently chasing too few available properties, which is a competitive condition that will not easily resolve itself without the creation of some meaningful supply.

As has been mentioned in prior agency missives, markets like Martha’s Vineyard have been experiencing inventory contraction for several years now, with rates of replenishment grossly lagging the level of consumption. Martha’s Vineyard simply does not have an ample amount of raw land to develop and thus create adequate new housing stock. New property listings are at an all-time low, but with the consistent high demand, premium sales prices can and likely will persist across the Island.

Here are some facts, observations, and opinions that may help you formulate your own point of view regarding the state of Martha’s Vineyard

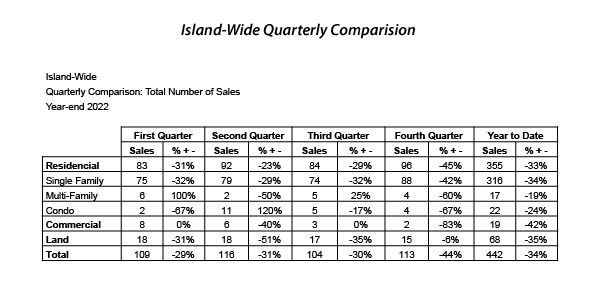

• The 4th Quarter again realized respectable volume in residential sales on-Island (comprised of single family, multi-family homes & condos) totaling (96), exceeding Q1 (83), Q2 (92) and Q3 (84). Interestingly, during the past several years, our “Fall Market” has become a stronger selling period than the customary “Spring Market”. However, with overall supply of inventory tightening, fewer properties may be sold and prices can remain elevated or increase. Therefore, this could be a cue for potential sellers to enter the market with new listings come spring, if not sooner. Please contact us to discuss the salability of your Island property.

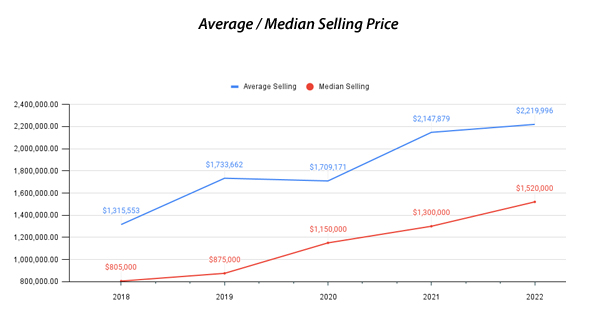

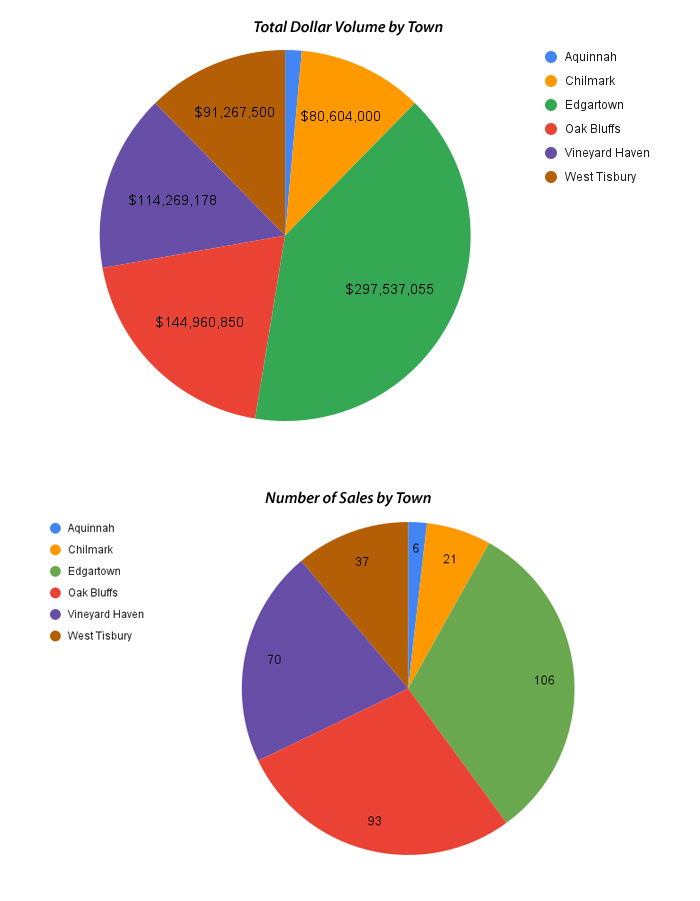

Market Statistics courtesy of LINK

• In 2022, residential sales on-Island were realized from all price segments and locales totaling 333 units, which was approximately 34% less than the 503 transacted in 2021. Median sales prices increased 17% from $1,300,000 to $1,520,000, while average sales prices rose just 3%, from $2,147,879 to $2,219,996, year over year.

• Sales prices on-Island captured 98% of their asking price, and garnered nearly 174% of their respective tax assessments in the aggregate. Each Town has its own metric in this regard that is worth being made aware.

• For the year, Island towns conveyed the following number of residential properties; Edgartown-106, Oak Bluffs-93, Vineyard Haven-70, West Tisbury-37, Chilmark-21, and Aquinnah-6.

• The Island is a finite commodity having both geographic and economic barriers of entry that promote various price supports not typically found in many primary real estate markets. Scarcity, location, condition and amenities continue to be key drivers toward establishing value and pricing. But in this era of Covid, “want and need” have become more significant and subjective variables affecting the decision-making process.

• As inventory continues to be depleted, prices have escalated as a function of supply and demand. It is not surprising that within a tight market condition, the better priced, better conditioned properties are going under contract more quickly. But candidly, this can be said of any inventory that becomes available on-Island because levels are at such extra-ordinarily low levels.

• Our successful 2022 clients have these best practices in common: Know your wants and needs, have reasonable expectations, understand your purchasing power well in advance as lending rates have increased, identify the market of opportunity as lean as it may be, expect multiple competitors, and “be prepared to act”.

This past year was unprecedented for so many and in so many unforeseen ways. And the confluence of the aforementioned variables has made finding available inventory more challenging on-Island. The next few months will be telling with respect to determining the levels of inventory the spring market may present, so stay tuned!

Certainly anything can happen, as was demonstrated during these past several years. And the Island’s resilience as a discretionary market of desire will again be tested. However, for those individuals who perform their due diligence, work with an experienced Realtor and are ready to take action, there are still opportunities to become a Buyer of Martha’s Vineyard real estate. And if you are seeking lending resources to meet your particular needs, please allow us to introduce you to local loan officers who have mortgage portfolios that meet our micro-market parameters.

To view a comprehensive list of all available Island listings for sale, please visit www.mvlandmarks.com And as always, do not hesitate to contact us with your questions concerning properties of interest, and Martha’s Vineyard real estate in general.