Happy summer from Martha’s Vineyard!

And welcome back to the ‘new normal’.

After a raucous return from Covid to an open society last summer, and the robust sales activity that it brought throughout the past nine months, there appears to be a shift lurking as we begin “high summer” on-Island. There is much to consider, so please allow us to share our mid-year market commentary concerning the sales activity on-Island thus far.

The fervor that sparked real estate transactions last year has carried into 2022. With the rather mild winter and the positive recovery efforts from Covid, coupled with the low mortgage rates available earlier this season, our sales activity continued pace into Q2. However, like last year, there again was not the typical ‘spring market’ activation of new inventory that is customary. It was suggested that due to some prospective sellers who used their Island properties as “Covid havens” last year, their absence would diminish, and they would return to market as sales prices continued to escalate as a result of the persistently high demand and low supply condition. However, this thesis may not fully address the constrained inventory condition on-Island. In fact, the answer may lie more simplistically in the fact that this micro-market is finite, and that since we have averaged over 400 residential sales annually during the past seven years, and that most properties purchased are considered “legacy assets” and do not intend to be resold in the foreseeable future, there simply isn’t much supply now available for resale.

Most industry pundits still do not see any correlation to the housing bubble of 2008, which was a credit-market driven crisis. The elements in play today are very different from then and were further exacerbated by Covid-19. However, the national supply and demand issue now affecting the housing market will more readily be resolved by most off-island markets than will be on Martha’s Vineyard for the simple reason that those communities have more land resources to develop and thus create new housing supply from than the Island has. The general take-away to consider is that a persistently low inventory condition coupled with consistent demand, will allow for prices on-Island to remain elevated. It is the supply variable that will change the complexion of this equation. But that is not expected to fundamentally change for the foreseeable future with the limited replenishment channels available on-Island.

Buyer sentiment toward Martha’s Vineyard has been stable for some time, as reflected by the above average rates of consumption during each of the past seven years. But the “you only live once” mentality that emerged from the 2020 Covid lockdowns, coupled with a desire to live in, and work from, a healthier environment (via Zoom), became significant variables contributing to the sense of urgency for many to investigate and acquire a property on Martha’s Vineyard. However, with the diminished choice of inventory due to recent consumption, rising mortgage interest rates, the ongoing geo-political and macro-economic issues, un-relenting Covid disruptions, and the “fearmongering media”, there has been a noticeable cooling effect upon our local real estate activities just since May.

How the balance of the year unfolds will be enlightening, but opportunities for the prepared will certainly present themselves, especially as we migrate toward the “Fall Market” which typically commences just prior to Labor Day.

Here are the more meaningful statistics to consider through Second Quarter 2022:

Despite the opening of the season and arrival of warmer temps, local inventory remains tight. At this time last year, there were 101 residential properties actively listed for sale. As of this moment, there are 136 units available Island-wide. From a historic perspective, there were typically 375-450 residential properties available for this time of year. In 2018, there were 558 available for purchase…

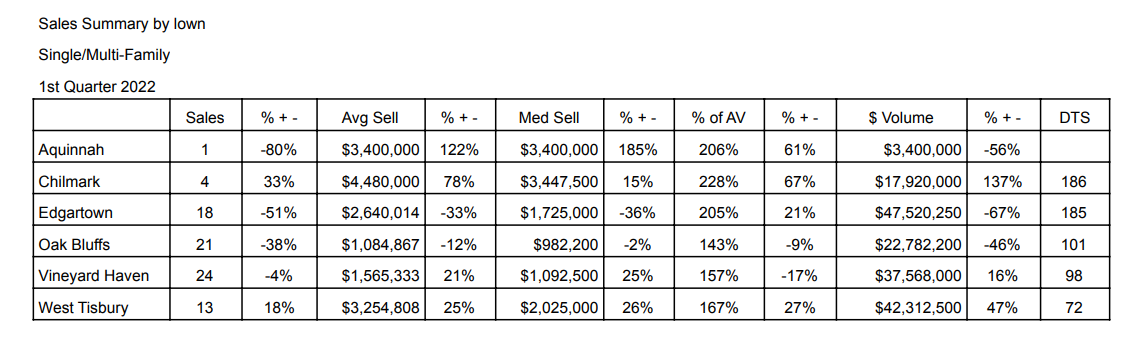

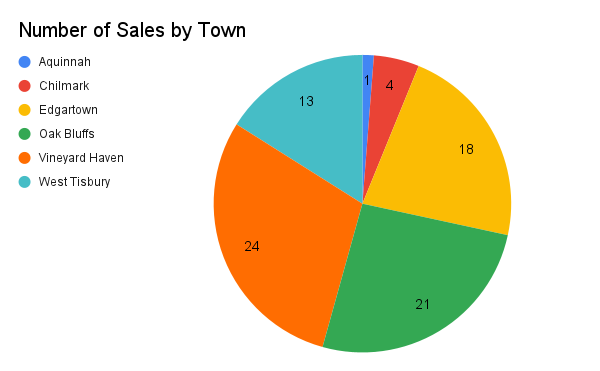

Thus far in 2022, a total of 162 residential properties were sold among the Island towns, which is down approximately 30% from last year’s sales of 229 for the same period: Edgartown-51, Oak Bluffs-41, Vineyard Haven-40, West Tisbury-19, Chilmark-9, and Aquinnah-2.

Number of Sales by Town

Median residential sale prices on-Island have moderated, flattening the recent sales price trajectory by increasing 12% from $1,325,000 to $1,480,000. While the average residential sale prices decreased modestly by 8% from $2,298,752 to $2,117,320 as compared to the same period in 2021.

Year-to-date residential sales in the aggregate have captured nearly 99% of their final asking prices and garnered approximately 168% of their respective tax assessments! The strength of this correlation is subject to factors such as condition, location, amenity, and uniqueness of the subject properties sold, but more importantly their competitiveness relative to available supply.

While decision-making drivers differ when deciding to acquire a vacation type home as compared to that of a primary residence, there are similar economic, emotional, logistic, and utilitarian variables that are employed when undertaking such a venture on-Island. Our agents are skilled and savvy in helping you identify and address each of these concerns. Please contact us for assistance to discuss your specific questions, curiosities, wants and needs, concerning Martha’s Vineyard real estate. And do regularly re-visit this website to keep abreast of all Island properties actively offered for sale.